DataQuick's November homes sales report for the Bay Area and San Francisco came out. You can read it here.

Once again the Bay Area's prices were down (1.4%), while San Francisco was up (0.7%) from November of last year. The quote from the report that jumps out at me is from DataQuick President Marshall Prentice who said "As prices stabilize and sellers get real about asking prices, a lot of the fence-sitters will jump in. We could see a moderate increase in sales counts".

In fact interest rates are incredibly low, and given that his comments are about the Bay Area in general, San Francisco is likely to see an even bigger boost in sales counts and price appreciation. In this "slow" market San Francisco has held up and even increased. As "fence-sitters" jump in, San Francisco may well see a decent run up in prices.

If I were a buyer I'd try to get in before March or April when sales heat up. And if I were a Seller I'd prepare my house for a March or April listing. Sellers - click on the "Free Home Value Service" link for a price evaluation report. Buyers, search for homes at either the "MLS Property Search" service, or "Auto Email Home Search" or at "CleanOffer".

1/5/07

12/1/06

Interest rates hit 2006 low

According to Bankrate.com the average California Jumbo interest rate is below 6%!!! With everyone predicting 7% to 8% interest rates, and indeed it hit 7% earlier this year, the sentiment was that the market had to fall. But what now?

I've been saying for several months now that I thought San Francisco would get hot again by or during the Spring of 2007. With interest rates this low, that's making my prediction a stronger one.

rates this low, that's making my prediction a stronger one.

I keep hearing reports of how tough it is in nearby markets - but near San Francisco is NOT San Francisco. Prices are UP this year compared to last year, and 2006 was "slow" in comparison to the last couple of years.

What will 2007 bring? Honestly it is anyone's guess. But there are plenty of Buyers around, still not that much for sale, and buying power is at it's highest since 2005. Buyers ought to be on the look out and ready to snap up anything they like before prices rise again, and Sellers should gear up for a Spring-time Listing.

I've been saying for several months now that I thought San Francisco would get hot again by or during the Spring of 2007. With interest

rates this low, that's making my prediction a stronger one.

rates this low, that's making my prediction a stronger one.I keep hearing reports of how tough it is in nearby markets - but near San Francisco is NOT San Francisco. Prices are UP this year compared to last year, and 2006 was "slow" in comparison to the last couple of years.

What will 2007 bring? Honestly it is anyone's guess. But there are plenty of Buyers around, still not that much for sale, and buying power is at it's highest since 2005. Buyers ought to be on the look out and ready to snap up anything they like before prices rise again, and Sellers should gear up for a Spring-time Listing.

11/24/06

Condo prices up 2.5% & SOMA high-rises

From the San Francisoc Chronicle on the high rise developments in the SOMA & South Beach neighborhoods

"Luxury Residences"

Finally some quotes from general media sources that are catching up to what I've been saying for a while now. This from the above article:

"So far, the San Francisco new condo sales, for the most part, have been sheltered from the kinds of decline other segments of the Bay Area housing market have seen. At the highest end, the market is an island governed by its own set of rules with buyers who have few financial constraints or in some cases are shopping for their second or third home."

"Luxury Residences"

Finally some quotes from general media sources that are catching up to what I've been saying for a while now. This from the above article:

"So far, the San Francisco new condo sales, for the most part, have been sheltered from the kinds of decline other segments of the Bay Area housing market have seen. At the highest end, the market is an island governed by its own set of rules with buyers who have few financial constraints or in some cases are shopping for their second or third home."

Luxury market hits record high

According to First Republic Bank's "Prestige Home Index" San Francisco's luxury market ($1 million or higher) is now at a record high of $2.96 million. That is a 1.1% increase in the 3rd quarter over the 2nd quarter of this year, and 4% higher than the 3rd quarter of 2005.

So much for the Bubble pundits - one of whom I just saw is going to try to charge for his blog. All he does is posts rants and raves about the market and people in it... now I can't see if he'll avoid this report since it flies in the face of his never ending bubble prediction.

Interestingly too is that San Francisco's luxury price of $2.96 million is higher than both San Diego's at $2.18 million and Los Angeles at $2.37 million.

So much for the Bubble pundits - one of whom I just saw is going to try to charge for his blog. All he does is posts rants and raves about the market and people in it... now I can't see if he'll avoid this report since it flies in the face of his never ending bubble prediction.

Interestingly too is that San Francisco's luxury price of $2.96 million is higher than both San Diego's at $2.18 million and Los Angeles at $2.37 million.

11/15/06

Most Active Home Sale months in San Francisco

I nearly forgot, but while researching for my previous post, I took a close look at number of homes sales per month. This is the "scary" number the mass media reports to say "homes sales dropped 34%" or whatever the latest figure is. Yes but... did price drop??? My previous post answers that - seasonally they do from one month to the next month, but year over year has been flat to slightly up the last 7+ months.

But what about those scary home sales numbers? Well, 2006 total homes sales appear to be off by about 20% from last year. But last year was the best on record. I believe this year will be the 3rd or 4th best on record, so plenty of homes are selling. But upon closer inspection, both years proved what most Realtors know.... that the highest number of sales occur in May & June.... BUT this is a tad misleading because this is when they "Close" and are reported as "sold". With most homes closing in 30 days, the actual sale is a month earlier. So if you're wondering when to sell, April & May are the most active months.

Next on the list are February & March, and then July through October. These 6 months appear to be roughly similar. The worst time to sell is December and January, with February a hit or miss month.

But what about those scary home sales numbers? Well, 2006 total homes sales appear to be off by about 20% from last year. But last year was the best on record. I believe this year will be the 3rd or 4th best on record, so plenty of homes are selling. But upon closer inspection, both years proved what most Realtors know.... that the highest number of sales occur in May & June.... BUT this is a tad misleading because this is when they "Close" and are reported as "sold". With most homes closing in 30 days, the actual sale is a month earlier. So if you're wondering when to sell, April & May are the most active months.

Next on the list are February & March, and then July through October. These 6 months appear to be roughly similar. The worst time to sell is December and January, with February a hit or miss month.

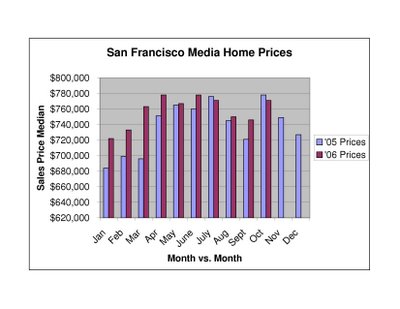

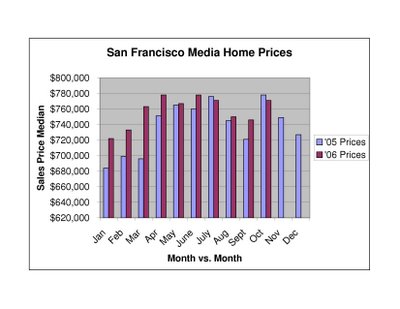

October Sales Data - results just in

San Francisco's market was down 0.9% from this October compared to October 2005. This according to DataQuick News.

But looking back to September's report, San Francisco Median Homes prices are up 3.35% in October over September.

This led me to look even closer, and it's very interesting. In 2005 prices peaked in July & October at $776k and $778k respectively (this is new and resale homes & condos per DataQuick). Then prices dropped, as they always seem to do November through February, and caught back up to the prices of 2005 from March through October of this year. The bottom line is that prices are mostly flat in a long term trend (well, a 10 month trend).

Here's the chart I created from the DataQuick reports:

You can see that earlier this year was well above early last year, whereas more recent months roughly match 2005's performance.

But looking back to September's report, San Francisco Median Homes prices are up 3.35% in October over September.

This led me to look even closer, and it's very interesting. In 2005 prices peaked in July & October at $776k and $778k respectively (this is new and resale homes & condos per DataQuick). Then prices dropped, as they always seem to do November through February, and caught back up to the prices of 2005 from March through October of this year. The bottom line is that prices are mostly flat in a long term trend (well, a 10 month trend).

Here's the chart I created from the DataQuick reports:

You can see that earlier this year was well above early last year, whereas more recent months roughly match 2005's performance.

11/14/06

San Francisco - a "superstar city"

Finally an explanation that improves upon my explanation of the San Francisco market:

This Business Week Online article explains that Economists from Wharton & Columbia business schools coined the term "super cities" for cities like San Francisco and Boston that have two factors that most other cities don't have.

1. People all over the world love San Francisco and want to live here. Not true of St. Louis, Houston, and numerous other cities. You know this if you ever travelled abroad and told them you were from San Francisco.

2. San Francisco and Boston both have limited supply - you can't build on 3 sides which are water, and in San Francisco, money gravitates to an even smaller part of the city - basically the northernmost neighborhoods from Pac Heights northward.

This article further states that it isn't only the limited land, but the regulatary zoning measures that limit building height and size. In San Francsico you're only seeing new high-rises in SOMA & South Beach. If you want Golden Gate Bridge views, or proximity to it, there is NOTHING new going up other then tear downs being rebuilt to the same small-ish sizes.

This is murder on first time home buyers which is why there are so many hateful activists and sour bubble proponents. They or their constituents are priced out of the San Francisco market, and it's becoming a town only the wealthy can afford. This could have negative long term effects - like negative population growth since so many people can't afford to live here, but if you can afford to buy here, rest assured.... many more wealthy people are being created every day around the world who would love to live here too. And while my personal political beliefs do NOT like what is happening with the disparity between the Haves and Have Nots, and I think something has to be done, the fact is that the Haves are growing in size and wealth, which will continue to drive prime SF prices for the foreseeable future.

This Business Week Online article explains that Economists from Wharton & Columbia business schools coined the term "super cities" for cities like San Francisco and Boston that have two factors that most other cities don't have.

1. People all over the world love San Francisco and want to live here. Not true of St. Louis, Houston, and numerous other cities. You know this if you ever travelled abroad and told them you were from San Francisco.

2. San Francisco and Boston both have limited supply - you can't build on 3 sides which are water, and in San Francisco, money gravitates to an even smaller part of the city - basically the northernmost neighborhoods from Pac Heights northward.

This article further states that it isn't only the limited land, but the regulatary zoning measures that limit building height and size. In San Francsico you're only seeing new high-rises in SOMA & South Beach. If you want Golden Gate Bridge views, or proximity to it, there is NOTHING new going up other then tear downs being rebuilt to the same small-ish sizes.

This is murder on first time home buyers which is why there are so many hateful activists and sour bubble proponents. They or their constituents are priced out of the San Francisco market, and it's becoming a town only the wealthy can afford. This could have negative long term effects - like negative population growth since so many people can't afford to live here, but if you can afford to buy here, rest assured.... many more wealthy people are being created every day around the world who would love to live here too. And while my personal political beliefs do NOT like what is happening with the disparity between the Haves and Have Nots, and I think something has to be done, the fact is that the Haves are growing in size and wealth, which will continue to drive prime SF prices for the foreseeable future.

11/9/06

Another Home Value tool - free and online

Cyberhomes.com is a new internet tool from Fidelity National Information Services that estimates home values, very similar to Zillow.com.

The site is in beta, and I've found several problems with it. For example, I entered 1921 Jefferson Street and tons of nearby properties showed up, but none of the condos in the building I was searching for came up. I had to look at the "comparables" to find the condo in the building I wanted. I also did one Value comparison with Zillow. 1500 Bay St #203 is worth $684,000 on Cyberhomes, but only $620,000 on Zillow. Read my previous post for why I'm skeptical of ANY online generated value. For the best home value without speaking to a Realtor, try mine at Evaluate-My-Home.com.

The site was occassionally painfully slow to move around on, but all in all this should be a very useful counter point to Zillow, and another free internet tool that continues to give more and more power and knowledge to consumers.

The site is in beta, and I've found several problems with it. For example, I entered 1921 Jefferson Street and tons of nearby properties showed up, but none of the condos in the building I was searching for came up. I had to look at the "comparables" to find the condo in the building I wanted. I also did one Value comparison with Zillow. 1500 Bay St #203 is worth $684,000 on Cyberhomes, but only $620,000 on Zillow. Read my previous post for why I'm skeptical of ANY online generated value. For the best home value without speaking to a Realtor, try mine at Evaluate-My-Home.com.

The site was occassionally painfully slow to move around on, but all in all this should be a very useful counter point to Zillow, and another free internet tool that continues to give more and more power and knowledge to consumers.

11/8/06

Sellers can "shop" your offer if you let them

Earlier this year the Realtor Association made it an ethical duty for it's members to "advise potential clients of the possibility that sellers or sellers representatives may not treat the existence, terms, or conditions of offers as confidential unless confidentiality is required by law, regulation, or by any confidentiality agreement between the parties."

They point out that California law doesn't require Sellers to keep terms confidential. They advise concerned Buyers to submit a "confidentiality agreement" which the Seller can choose to accept, reject or ignore.

Why the "new" concern? Interestingly it's been a misperception of most practicing Realtors that offers could not be disclosed to other Buyers in an effort to drive the sales price up. I even watched a "Million Dollar Listing" TV episode in which one of the Realtors stated this, and the screen had a little caption stating that it was illegal to tell other buyers about offers. In fact, it's neither illegal, or unethical. I personally think it often can be the "right" thing to do for both Buyers and Sellers.

A recent example is a Condo that got 4 offers on it, and the 2nd best priced offer was the "best" in my Seller's eyes, except for the price. This particular Buyer had shown enormous interest in the Condo, so we told him how much the higher offer was, and he chose to beat it to get the Condo. You might think this unfair to the original highest offer, but there were a multitude of problems with their offer and we just didn't trust their intentions to follow through on their offer.

So the Seller got an even higher sales price, and the most interested buyer got the property. Whether you think it's a good idea or not to share the details of other offers with other buyers, the bottom line is that it is NOT illegal.

They point out that California law doesn't require Sellers to keep terms confidential. They advise concerned Buyers to submit a "confidentiality agreement" which the Seller can choose to accept, reject or ignore.

Why the "new" concern? Interestingly it's been a misperception of most practicing Realtors that offers could not be disclosed to other Buyers in an effort to drive the sales price up. I even watched a "Million Dollar Listing" TV episode in which one of the Realtors stated this, and the screen had a little caption stating that it was illegal to tell other buyers about offers. In fact, it's neither illegal, or unethical. I personally think it often can be the "right" thing to do for both Buyers and Sellers.

A recent example is a Condo that got 4 offers on it, and the 2nd best priced offer was the "best" in my Seller's eyes, except for the price. This particular Buyer had shown enormous interest in the Condo, so we told him how much the higher offer was, and he chose to beat it to get the Condo. You might think this unfair to the original highest offer, but there were a multitude of problems with their offer and we just didn't trust their intentions to follow through on their offer.

So the Seller got an even higher sales price, and the most interested buyer got the property. Whether you think it's a good idea or not to share the details of other offers with other buyers, the bottom line is that it is NOT illegal.

Free Booklet: "General Information for Buyers & Sellers of Real Property

The San Francisco Association of Realtors puts out a San Francisco specific "General Information" document that is currently 45 pages long. You'll note in the Table of Contents that much of it is probably not of interest to you, so there's no need to read all 45 pages. However, it does an excellent job of explaining basic real estate procedures how to "Take Title", "Obtaining Homeowner's Insurance", describes various Taxes, the Escrow process and more.

I can email you a PDF version of this free booklet, so if you're interested, just send an email to me at RobR@kw.com with your request.

I can email you a PDF version of this free booklet, so if you're interested, just send an email to me at RobR@kw.com with your request.

11/6/06

Fixers - are they the deal you think they are?

When the market is hot, everything is hot, and oddly enough it's almost more so for "fixers" or homes that need work. Many buyers still want a "deal" and they think they can buy the less attractive home at a discount, and earn "sweat equity" by fixing it up.

In reality most non-contractors under estimate the cost and time of repairs. Plus, the competition for the fixer ends up driving the price up. Even in today's more realistic market, you still have a LOT of interest in fixer uppers, so here are a few tips to make sure the deal you find, really is a deal.

1. Know your exit strategy - are you buying to sell for a profit down the road, or buying because you want to create your ideal home, and profit is not the goal. Don't try to do both, because if profit is your goal, you MUST be frugal in all aspects of the fix and skip the more expensive but "ideal" choices like top of the line appliances. Buy the best value ones. Also, don't over-improve for the neighborhood or the condo complex. You are better off being the least expensive home in the neighborhood rather than the most expensive. Bring the home up to the standard of the neighborhood, and not much more. Comparison shop for all products and services.

2. Set your maximum offer price, and be willing to walk away if other buyers bid it up. If you pay too much for a fixer, then you might as well just buy a newer home and save your time and energy if you won't get a monetary gain for all your effort.

3. Make your offer contingent on inspections, and then bring in contractors for estimates on bigger repairs so you know the "true" cost when buying. If you discover you made a mistake, either cancel the contract subject to your Inspection contingency, or ask for a price reduction in the amount of the repairs you had not expected. You can buy a home with foundation damage, severe mold, or roof problems that scare other buyers away if you know from a contractor how long it will take to repair, and how much, and when added on top of your purchase price it really is a deal.

4. Pre-plan your profit and make it high enough compared to the value of your time and effort. If you're only going to save $20,000 and it's going to take you 6 months of time and frustration, is it really worth it? That's a decision only you can make and will be situational for each buyer and property.

5. Consider the neighborhood - if it's a bad neigbhorhood and isn't likely to improve by the time you sell, you're going to want a bigger discount since better neighborhoods maintain their value and sell easier.

In reality most non-contractors under estimate the cost and time of repairs. Plus, the competition for the fixer ends up driving the price up. Even in today's more realistic market, you still have a LOT of interest in fixer uppers, so here are a few tips to make sure the deal you find, really is a deal.

1. Know your exit strategy - are you buying to sell for a profit down the road, or buying because you want to create your ideal home, and profit is not the goal. Don't try to do both, because if profit is your goal, you MUST be frugal in all aspects of the fix and skip the more expensive but "ideal" choices like top of the line appliances. Buy the best value ones. Also, don't over-improve for the neighborhood or the condo complex. You are better off being the least expensive home in the neighborhood rather than the most expensive. Bring the home up to the standard of the neighborhood, and not much more. Comparison shop for all products and services.

2. Set your maximum offer price, and be willing to walk away if other buyers bid it up. If you pay too much for a fixer, then you might as well just buy a newer home and save your time and energy if you won't get a monetary gain for all your effort.

3. Make your offer contingent on inspections, and then bring in contractors for estimates on bigger repairs so you know the "true" cost when buying. If you discover you made a mistake, either cancel the contract subject to your Inspection contingency, or ask for a price reduction in the amount of the repairs you had not expected. You can buy a home with foundation damage, severe mold, or roof problems that scare other buyers away if you know from a contractor how long it will take to repair, and how much, and when added on top of your purchase price it really is a deal.

4. Pre-plan your profit and make it high enough compared to the value of your time and effort. If you're only going to save $20,000 and it's going to take you 6 months of time and frustration, is it really worth it? That's a decision only you can make and will be situational for each buyer and property.

5. Consider the neighborhood - if it's a bad neigbhorhood and isn't likely to improve by the time you sell, you're going to want a bigger discount since better neighborhoods maintain their value and sell easier.

10/27/06

Zillow complaint sent to FTC

As this article says "... it is almost an open joke, the information on this website." Whether this non-profit group's complaint to the FTC about the obvious inaccuracies of the Zillow service goes anywhere or not, it should be easy enough for any consumer (potential home buyer or seller) to easily discover that Zillow is nothing more than a "toy" as one blogger called it, or a "research tool" as Zillow calls it. The bottom line, never trust any home valuation unless it's been done by an expert, who has visited the home, and thoroughly evaluated all possible comparable properties. And for a superior San Francisco home valuation service, check out www.Evaluate-My-Home.com

San Francisco's Luxury market

The luxury market is unique from the rest of the market, but it's sure fun to watch. So if you'd like to spy on the luxury market, here's the blog for you:

luxurysfhomes.blogspot.com

luxurysfhomes.blogspot.com

Days on Market - not always what it seems

A client of mine let me know how excited he was about a TIC (Tenancy-in-Common) he saw at 1551 Filbert Street. Priced at $729,000 the apartment had apparently been on the market for 34 days. This is about the time that San Francisco listings become "stale" and ripe for negotiation. What's more, the person hosting the Open House claimed that he was the owner, and if the Buyer worked without an agent he'd save on both ends of the commission and would drop the price to $685,000.

My client shyly shared this story with me because he didn't want to upset me, nor miss out on the opportunity. But this is just where the story begins, and the reason why I say over and over again "be careful of listing agents who say you don't need your own agent."

The reality of this listing is that it's been on the market for over 10 months. It's been taken off the MLS (Multiple Listing Service) twice, only to be re-listed soon after. The effect of the re-listing is that it appears to be a NEW listing, and the Days on Market (DOM) starts all over again. The first time it went on was January 26th 2006 priced at $749,000. 5 months later they dropped the price to $729,000, and 5 weeks after that they took it off the market for the first time - this was July 27th, 2006. On July 31st it was re-listed at $729,000 and after 25 days was removed once again. On Sept 11th 2006 it went right back on, priced once again at $729,000. My client visited it for the first time on Sunday October 15th. Per the MLS, they never went into contract, so they either never got an offer in 10 months, or never one they accepted for which the Buyer cancelled. Either way, this is RIPE for negotiation, and my initial reaction in seeing the 10 months of no offers was that it isn't even worth $685,000.

The next step for me - after discovering that with 10 months of marketing, a price change, and 3 listing periods, they STILL can't sell it - is to find out why. The obvious answer is that it must be priced too high, so I'll need to run a "CMA" (Comparable Market Analysis) to find the sales prices of similar properties that have sold recently. To do that I need to know the property's features. One is it's size, and here's another VERY UNUSUAL item in the listing that ALL buyers would miss. The Square Feet is listed as 980, but the "source" is "measured by Agent". That's the first time I noticed that, and since the person hosting the open house also seemed to indicate that he was the agent as well as the owner, it all started to sound a little too fishy... enough so that I'd suggest not trusting his measuring ability.

But here is a rough CMA - a report of all TIC sales in the past 6 months with 1 to 2 bedrooms, and 1 bathroom, within a 1/2 mile radius of 1551 Filbert (reports expire after 30 days - email if you'd like it recreated and emailed back). The "average" sales price is $645,850 which is often the most likely fair market value for the subject home. So his offer of $685,000 doesn't sound like much of an offer. On the other hand, two other apartments in the same building sold for $769,000 and $708,500. Frankly, I think both over-paid since the $769,000 took 94 days to sell, and the $708,5000 104 days to sell. I'd never advise my buyers to pay "asking" price on anything that's been on the market more than 60 days, but that's negotiation for you. But since the more recent sale was $708,500, this is the MOST the remaining apartment is worth in my mind. But since it's been another 4 months without a sale, I'd definitely go lower than that.

Secondly, in 6 months only 10 other comparable TIC's have sold, or an average of less than 2 per month. Yet 11 are on the market right now, which is 6 months worth of inventory. So it could be 6 more months before 1551 Filbert #4 sells (if it ever sells the way it's going). Thirdly, while the average of those that sold is $645k, the majority sold for $675,000 or less with 4 in the mid to low $500's. Additionally, while this apartment has parking, it is a shared "tandem" spot, which certainly reduced convenience and reduces the property's value.

Finally, I ran a CMA for Condos which are known to be worth more than TIC's for several reasons (see my previous post), usually running 10% to 30% more than TIC's. So this Condo CMA shows the average sales price of similar size and location Condos is $728,000. In other words, at the current 10 month long listing price they have it priced like it was a Condo, and not a less valuable TIC. Knock off 10% (the least I'd suggest) and you've got a $655,000 fair market value which roughly matches the TIC CMA.

My client is debating making an offer because, after hearing all of the above details, he is turned off to the property. But if he still likes the place, I'm encouraging him to make an offer matching the "average" of $645,850, or maybe even less and seeing how the other side responds.

For similar due dilligence on any property you are interested in, feel free to contact me.

My client shyly shared this story with me because he didn't want to upset me, nor miss out on the opportunity. But this is just where the story begins, and the reason why I say over and over again "be careful of listing agents who say you don't need your own agent."

The reality of this listing is that it's been on the market for over 10 months. It's been taken off the MLS (Multiple Listing Service) twice, only to be re-listed soon after. The effect of the re-listing is that it appears to be a NEW listing, and the Days on Market (DOM) starts all over again. The first time it went on was January 26th 2006 priced at $749,000. 5 months later they dropped the price to $729,000, and 5 weeks after that they took it off the market for the first time - this was July 27th, 2006. On July 31st it was re-listed at $729,000 and after 25 days was removed once again. On Sept 11th 2006 it went right back on, priced once again at $729,000. My client visited it for the first time on Sunday October 15th. Per the MLS, they never went into contract, so they either never got an offer in 10 months, or never one they accepted for which the Buyer cancelled. Either way, this is RIPE for negotiation, and my initial reaction in seeing the 10 months of no offers was that it isn't even worth $685,000.

The next step for me - after discovering that with 10 months of marketing, a price change, and 3 listing periods, they STILL can't sell it - is to find out why. The obvious answer is that it must be priced too high, so I'll need to run a "CMA" (Comparable Market Analysis) to find the sales prices of similar properties that have sold recently. To do that I need to know the property's features. One is it's size, and here's another VERY UNUSUAL item in the listing that ALL buyers would miss. The Square Feet is listed as 980, but the "source" is "measured by Agent". That's the first time I noticed that, and since the person hosting the open house also seemed to indicate that he was the agent as well as the owner, it all started to sound a little too fishy... enough so that I'd suggest not trusting his measuring ability.

But here is a rough CMA - a report of all TIC sales in the past 6 months with 1 to 2 bedrooms, and 1 bathroom, within a 1/2 mile radius of 1551 Filbert (reports expire after 30 days - email if you'd like it recreated and emailed back). The "average" sales price is $645,850 which is often the most likely fair market value for the subject home. So his offer of $685,000 doesn't sound like much of an offer. On the other hand, two other apartments in the same building sold for $769,000 and $708,500. Frankly, I think both over-paid since the $769,000 took 94 days to sell, and the $708,5000 104 days to sell. I'd never advise my buyers to pay "asking" price on anything that's been on the market more than 60 days, but that's negotiation for you. But since the more recent sale was $708,500, this is the MOST the remaining apartment is worth in my mind. But since it's been another 4 months without a sale, I'd definitely go lower than that.

Secondly, in 6 months only 10 other comparable TIC's have sold, or an average of less than 2 per month. Yet 11 are on the market right now, which is 6 months worth of inventory. So it could be 6 more months before 1551 Filbert #4 sells (if it ever sells the way it's going). Thirdly, while the average of those that sold is $645k, the majority sold for $675,000 or less with 4 in the mid to low $500's. Additionally, while this apartment has parking, it is a shared "tandem" spot, which certainly reduced convenience and reduces the property's value.

Finally, I ran a CMA for Condos which are known to be worth more than TIC's for several reasons (see my previous post), usually running 10% to 30% more than TIC's. So this Condo CMA shows the average sales price of similar size and location Condos is $728,000. In other words, at the current 10 month long listing price they have it priced like it was a Condo, and not a less valuable TIC. Knock off 10% (the least I'd suggest) and you've got a $655,000 fair market value which roughly matches the TIC CMA.

My client is debating making an offer because, after hearing all of the above details, he is turned off to the property. But if he still likes the place, I'm encouraging him to make an offer matching the "average" of $645,850, or maybe even less and seeing how the other side responds.

For similar due dilligence on any property you are interested in, feel free to contact me.

Subscribe to:

Posts (Atom)